Liquidity staking

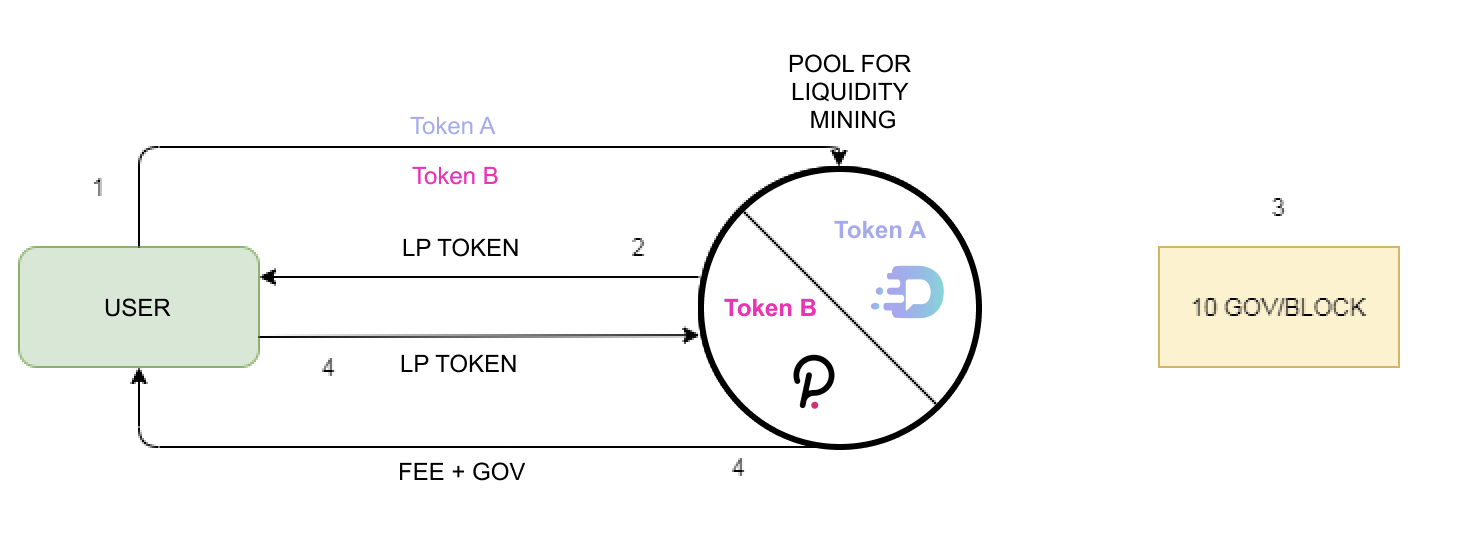

Liquidity provider is rewarded with exchange fee and an additional reward.

All liquidity pools contains a balance of two tokens, and the exchange rate is the amount of one token divides that of the other. Demodyfi users benefits instant token swap without the need for an order book like centrale exchanges, whereas liquidity provider could supply liquidity of the two tokens in a pool to earn a fee and enjoy one the economics incentives.

The Demodyfi platform has governance tokens (*DGOV) that it wants to distribute. To do this, users can choose different pools from which these DGOV can be received through liquidity mining. As long as the tokens provided by the user remain in the pool, he earns both 0.3% swap and the governance tokens that are “mined” at each block.

Users enter into the pooling of their choice. As the platform introductory launch offer, the platform will generate more DMOD rewards per block during the first days, from the launch of the platform, divided by the proportional share of the pool. The APY calculation is based on the return in ETH/DOT to the daily USD value, based on current the block returns annualized. It is not a fixed return, it is not a promised re-turn, it is based on ETH/DOT returns. If you have provided liquidity to a Liquidity Pool that is available for rewards there will be a bright DMOD that can be earned with just a few clicks on our pooling page.

DOT Staking Beta

Polkadot uses NPoS (Nominated Proof-of-Stake) as its mechanism for selecting the validator set. It is designed with the roles of validators and nominators, to maximize chain security. Polkadot network targets 50% active DOT staking with a 20% annual return. Effectively, this creates an opportunity cost for using DOT in other applications versus staking.

Ethereum as it currently stands as a PoW network has no such barrier, and in fact, has an incentive for ETH holder to participate in DeFi applications like MakerDAO or Compound. On the other hand, if DeFi lending applications provide a better yield than staking, it could motivate the collective movement of funds from staking to lending, causing a 'bank run' and risking the security of the entire network.

Our goal is to establish a decentralized staking pool where users would lock their GLMR / DOTs to gain staking yield while receiving a receipt that is liquid and tradable. We are currently in talk with other parties like Acala and moonbeam to integrate these features.

Last updated

Was this helpful?